Share

- Jump to:

25 Catering Stats You Need to Know in 2025

The catering industry is evolving rapidly, driven by corporate demand, technological innovation, and changing guest preferences. As businesses increasingly rely on catering for corporate events and workplace gatherings, restaurants have a tremendous opportunity to grow revenue by investing in tools, technology, and menu strategies that meet these needs. The rise of first-party ordering platforms, advancements in CRM and delivery solutions, and the growing emphasis on menu optimization are reshaping how catering operations are managed and marketed.

Corporate Catering Growth and Opportunities

Corporate catering continues to dominate the market, offering restaurants a reliable revenue stream and exposure to new customers. Targeting corporate events is critical for long-term growth and retention.

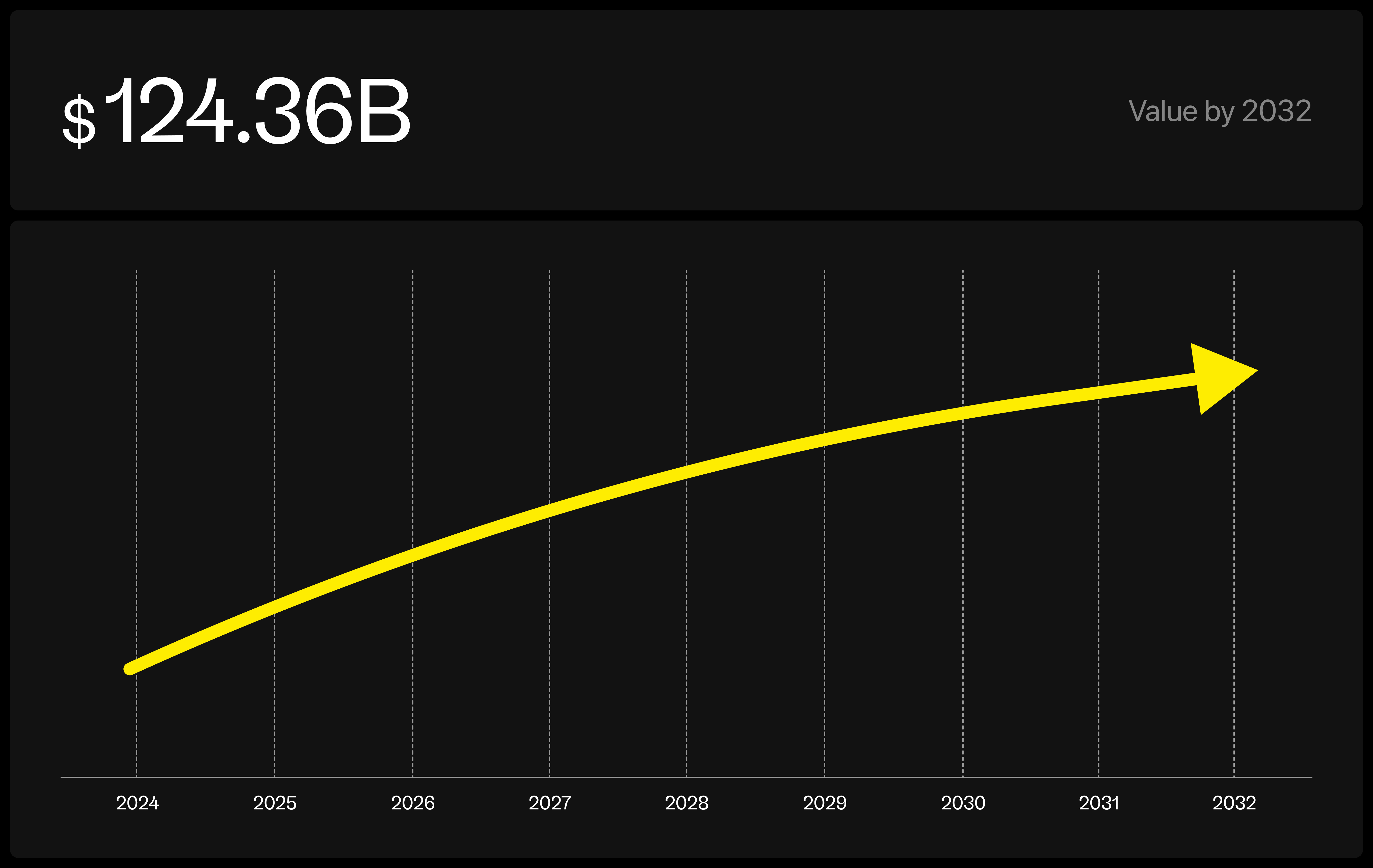

$124 Billion by 2032: The catering market is expected to grow at a CAGR of 6.2%, reaching $124 billion by 2032.

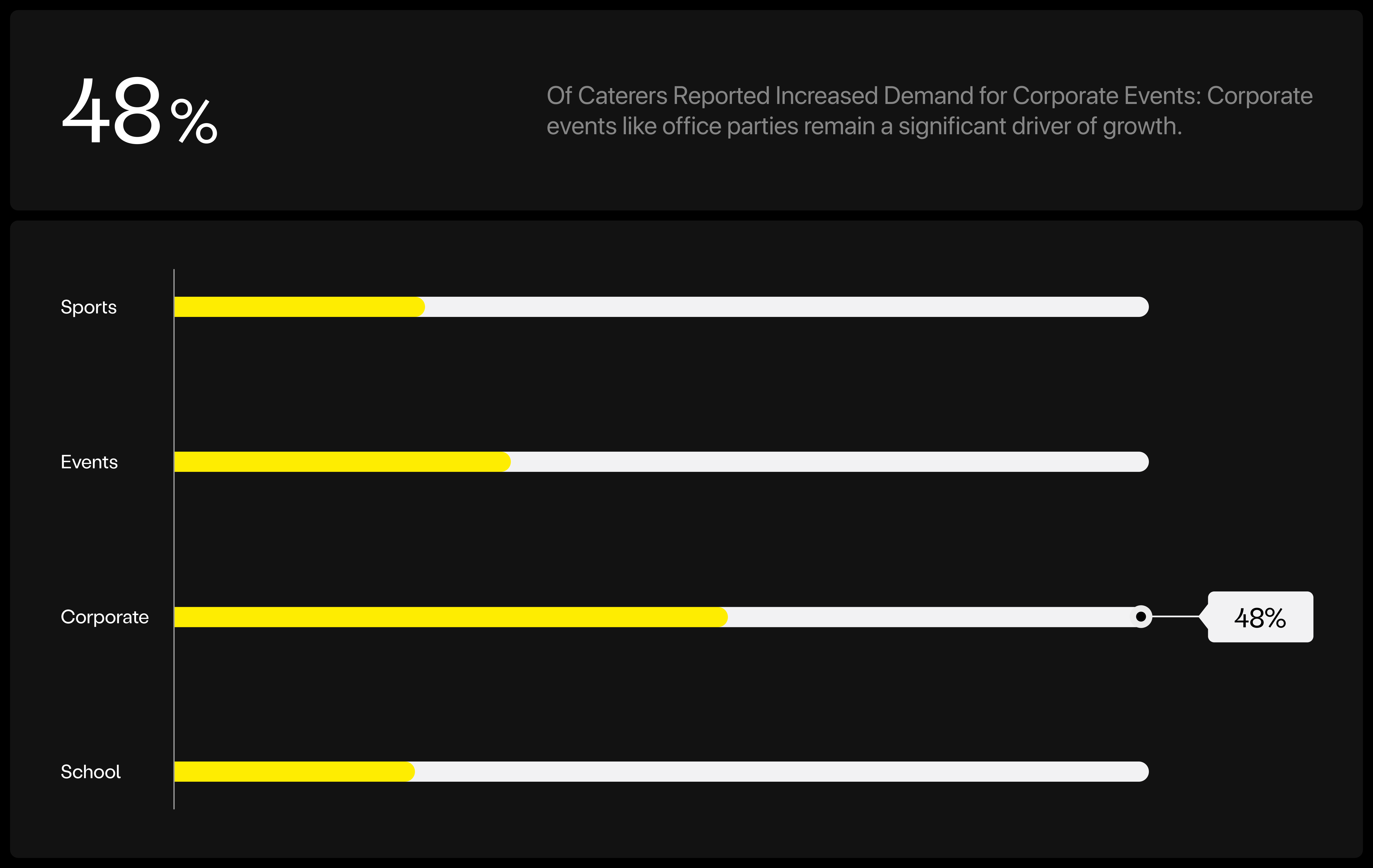

48% Growth in Corporate Catering: Nearly half of caterers reported corporate events as their largest growth area.

Corporate Catering is 60% of the Market: Corporate events account for the majority of catering demand.

80% of Companies Order Monthly: Most businesses order catering at least once a month, with 32% ordering weekly.

25 Guests per Order: The average catering order exposes a brand to 25 new guests, creating significant marketing opportunities.

Technology and Operational Efficiency

Technology is transforming catering operations, providing restaurants with tools to scale efficiently, streamline processes, and maximize profits. From CRM software to direct online ordering platforms, investing in tech is crucial for long-term success.

9:1 ROI from Tech: Restaurants investing in catering technology see a 9:1 return on investment after one year.

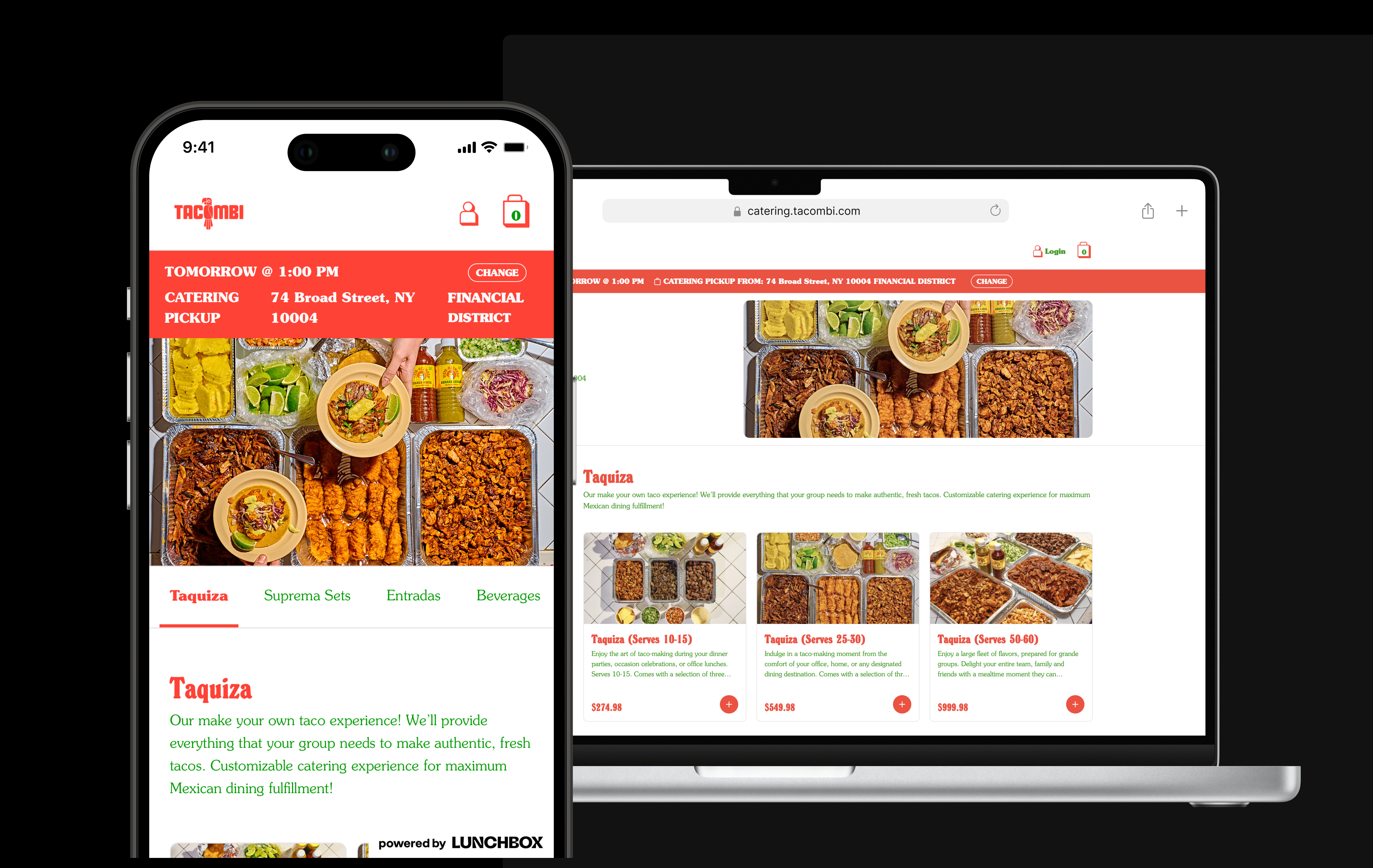

75% of Orders Take Place Online: A smooth digital ordering experience is critical, as most orders occur online.

Revenue Loss to Third Parties: Over 5% of catering revenue is lost to third-party commissions, emphasizing the need for direct ordering channels.

Businesses Using CRM See a 41% Revenue Boost: CRM software enables restaurants to manage guest data and drive marketing efforts effectively.

20% Growth in Mobile Catering: Mobile catering is growing faster than traditional segments, reflecting shifting consumer preferences.

Menu Optimization and Guest Preferences

A well-crafted menu is the backbone of any successful catering operation. By offering customization, meeting dietary preferences, and upselling add-ons, restaurants can boost revenue and satisfy diverse customer needs.

Vegetarian Options: Vegetarian items are included in 22% of catering orders, reflecting the demand for plant-based meals.

81% of Guests Tip: Guests tipping on catering orders leave an average tip of 8%, indicating customer satisfaction and additional staff income.

Add-Ons Drive Revenue: 40% of first-party catering orders include add-ons like chips or guacamole, increasing check sizes.

$500+ Average Check on Lunchbox: Restaurants using Lunchbox Catering see higher check averages, exceeding $500 per order.

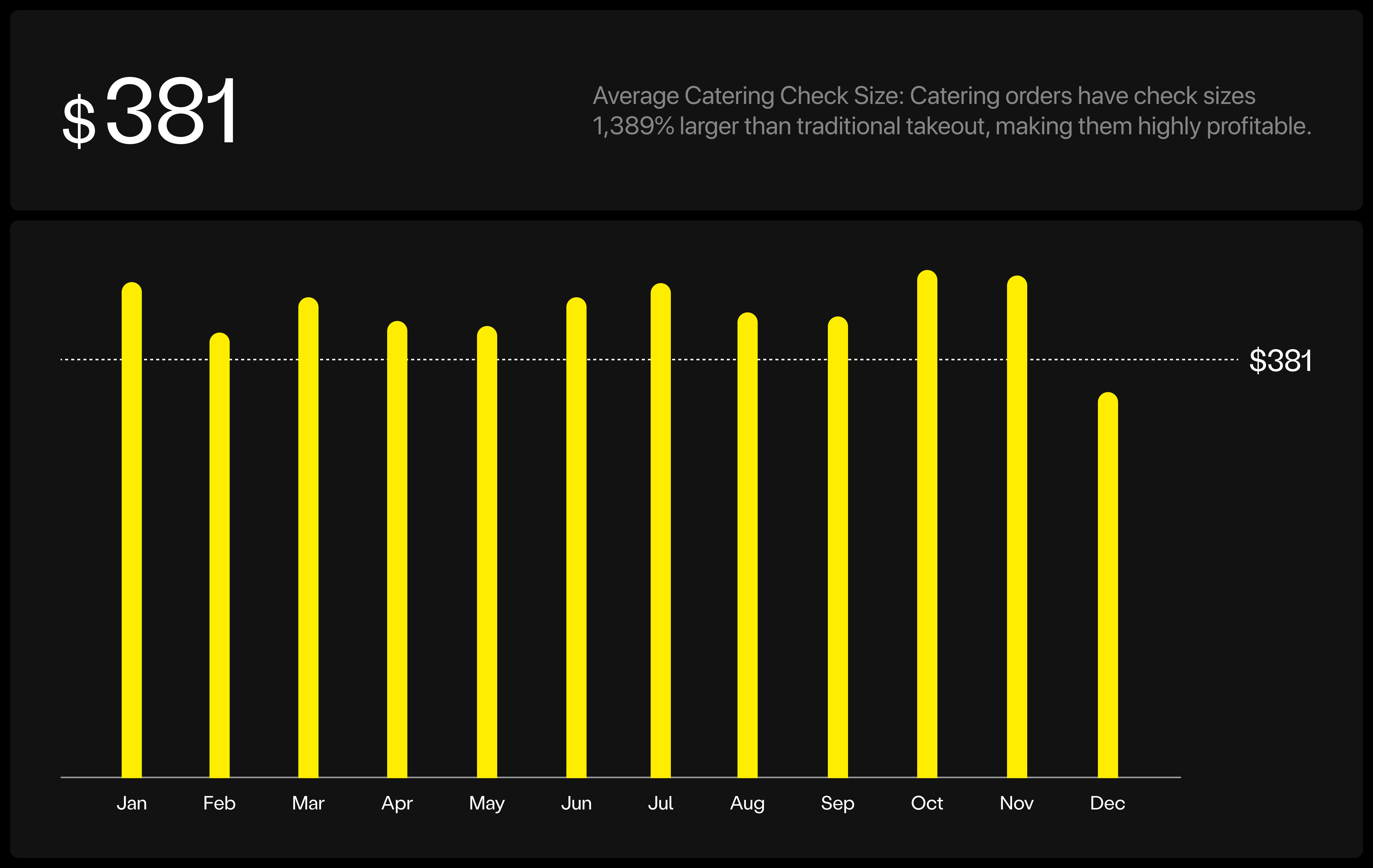

$381 Average Catering Check Size: Catering orders have check sizes 1,389% larger than traditional takeout, making them highly profitable.

Guest Behavior and Loyalty

Retaining loyal guests and understanding their behaviors are essential for sustaining growth. High-frequency customers and repeat business can have a significant impact on catering revenue.

High Growth in Frequency: Guests ordering five or more times annually increased by 286% year-over-year.

20% of Catering Customers Are Repeat Guests: proving that loyal customers are vital for sustainable growth and the importance of creating sound retention strategies.

Top Ordering Days: Wednesdays, Thursdays, and Tuesdays are the busiest for catering, requiring careful planning and ample prep time for both back and front of house.

48% of Caterers Reported Increased Demand for Corporate Events: Corporate events like office parties remain a significant driver of growth.

The catering industry is entering a transformative phase, driven by technology, strategic menu engineering, and the growing demand for corporate services. Restaurants that prioritize operational efficiency, invest in first-party digital tools, and focus on guest satisfaction will be well-positioned to thrive in 2025 and beyond. By leveraging these insights and trends, businesses can unlock new revenue streams, foster long-term customer relationships, and secure a competitive edge in the ever-evolving catering landscape.